|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Bankruptcy Attorney Pasadena: Your Guide to Financial Recovery

Bankruptcy can be a daunting process, but with the help of a skilled bankruptcy attorney in Pasadena, you can navigate this challenging time with greater ease and confidence. This guide will help you understand the role of a bankruptcy attorney and what to expect during the process.

Understanding the Role of a Bankruptcy Attorney

A bankruptcy attorney provides essential support and legal advice throughout the bankruptcy process. They will assess your financial situation, explain your options, and help you determine the best course of action.

Key Responsibilities

- Advising on eligibility for Chapter 7 or Chapter 13 bankruptcy.

- Filing necessary paperwork and representing you in court.

- Negotiating with creditors to protect your assets.

The Bankruptcy Process

Filing for bankruptcy involves several steps, and having an attorney can make the process smoother.

Initial Consultation

During your first meeting, your attorney will gather information about your financial situation to understand your specific needs.

Filing for Bankruptcy

Your attorney will prepare and file the necessary documents, ensuring all procedures are followed correctly.

Meeting of Creditors

This meeting allows creditors to ask questions about your financial situation. Your attorney will be by your side to provide support and representation.

Choosing the Right Attorney in Pasadena

Choosing the right attorney is crucial. You should consider their experience, reputation, and communication skills.

- Check reviews and testimonials from previous clients.

- Verify their credentials and years of experience in bankruptcy law.

- Discuss fees and payment plans upfront.

If you're also considering options outside Pasadena, you might explore an oklahoma city bankruptcy attorney for comparison.

Common Bankruptcy Myths

Many misconceptions exist about bankruptcy. It's important to separate fact from fiction.

Myth: Bankruptcy Ruins Your Financial Future

Reality: Bankruptcy offers a fresh start, and many people rebuild their credit over time.

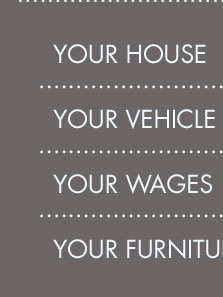

Myth: You Will Lose Everything

Reality: Many assets can be protected through exemptions and negotiations with creditors.

For further reading on bankruptcy myths, consider looking into the experiences shared by an olympia bankruptcy attorney.

FAQ

What does a bankruptcy attorney do?

A bankruptcy attorney helps clients understand their options, file necessary paperwork, and represent them in court proceedings.

How can I find a good bankruptcy attorney in Pasadena?

Research online reviews, check credentials, and ask for recommendations from friends or financial advisors.

Will bankruptcy eliminate all my debts?

Bankruptcy can discharge many types of unsecured debt, but certain debts like student loans and taxes may not be eliminated.

Bordeaux Law, P.C. offers bankruptcy services to individuals and business owners in Los Angeles County, Orange County, Ventura County, and Santa Barbara County.

2. Low Cost Bankruptcy Lawyer. We believe in providing quality representation with a fair and reasonable fee. Our fees start at $925. We understand you are ...

In this valuable book, Pasadena bankruptcy attorney and author, Daniela Romero, walks you through bankruptcy and the bankruptcy process. In it, you will learn ...

![]()